by Rich Blakemore | Jan 28, 2024 | QuickBooks Desktop

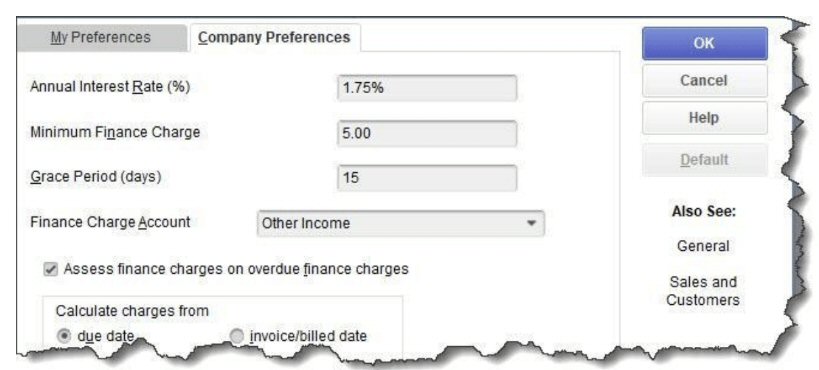

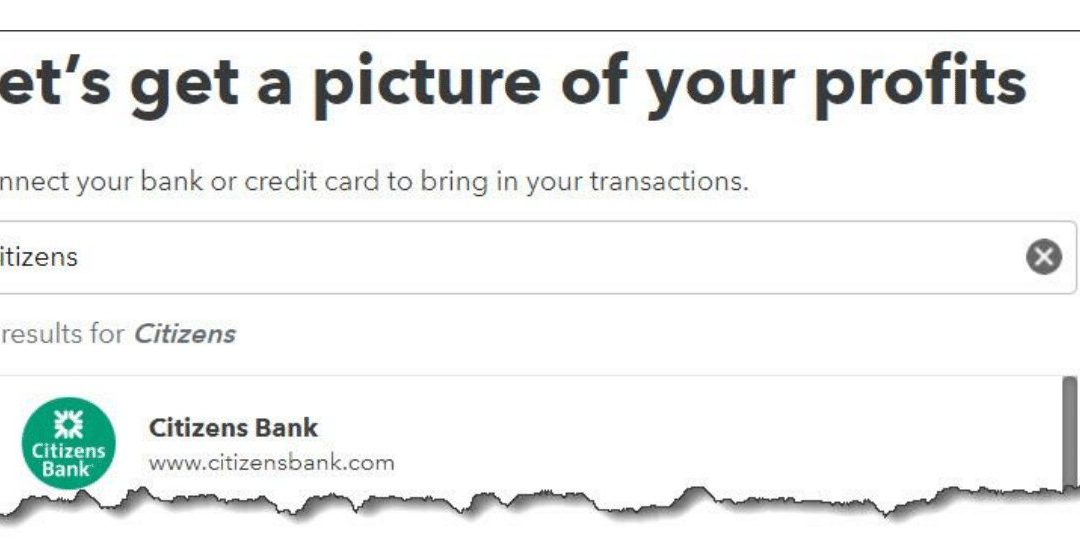

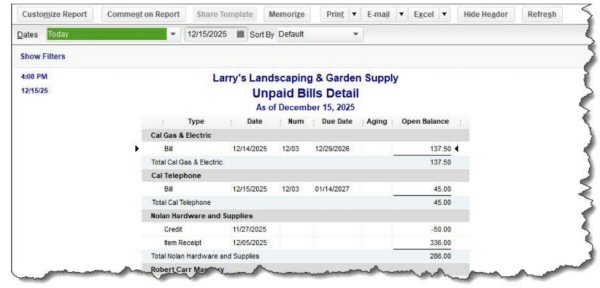

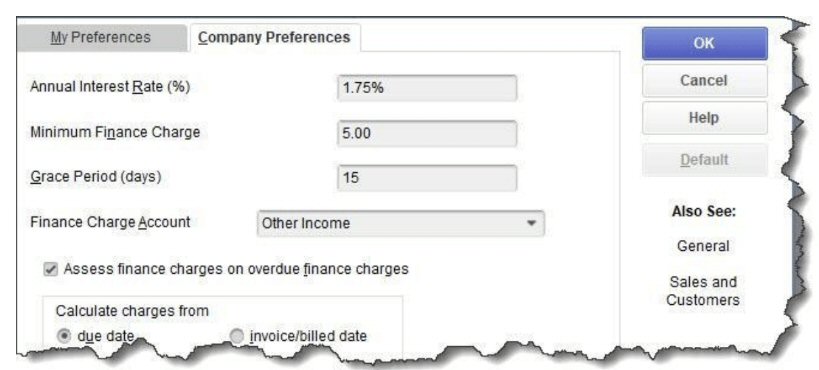

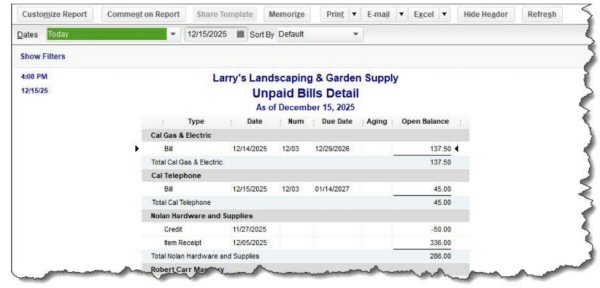

Are your receivables out of control? QuickBooks can help you assess finance charges. Now that we’re past the holidays and you’ve had January to catch up on the December work that didn’t get done, how’s your financial workflow? Are you caught up on bills and invoices?...

by Rich Blakemore | Jan 28, 2024 | Quickbooks Online

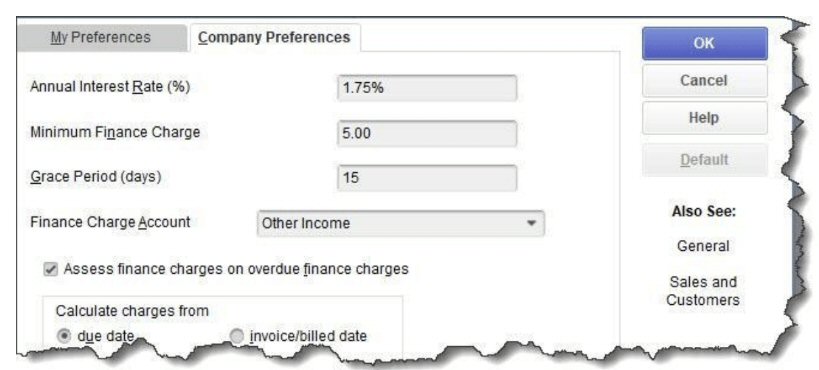

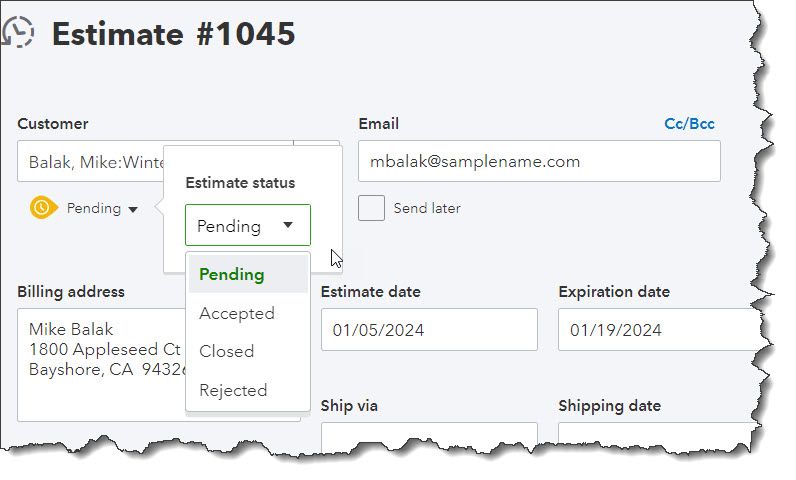

QuickBooks Online provides tools for creating estimates and converting them to invoices. Here’s how it works. You’ve probably received estimates before. Maybe you needed work done on a vehicle. Your dentist might have warned you how much a new crown would cost. If...

by Xpressley Bookkeeping | Nov 16, 2023 | Accounting, Bookkeeping News, Uncategorized

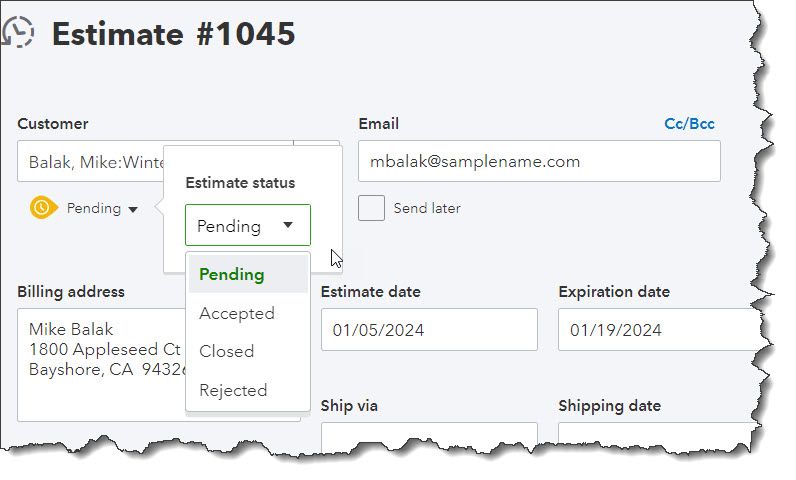

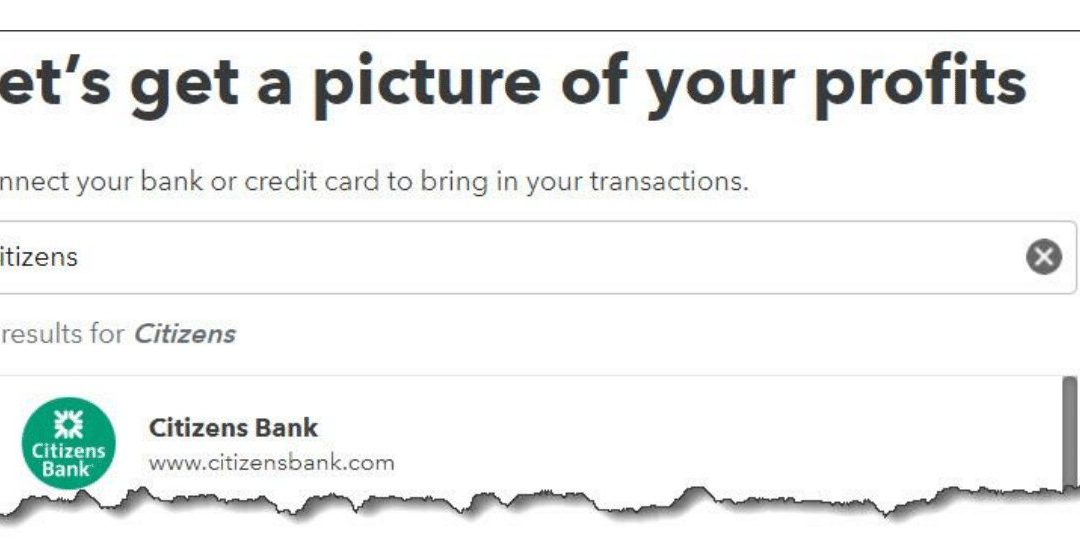

QuickBooks Online makes this an easy trip but be sure you know how the site handles them once you’ve moved them. Manual transaction entry doesn’t make sense anymore–not when QuickBooks Online makes the process of importing them from your bank so easy. If you enter...

by Xpressley Bookkeeping | Nov 16, 2023 | Accounting, Bookkeeping News, Uncategorized

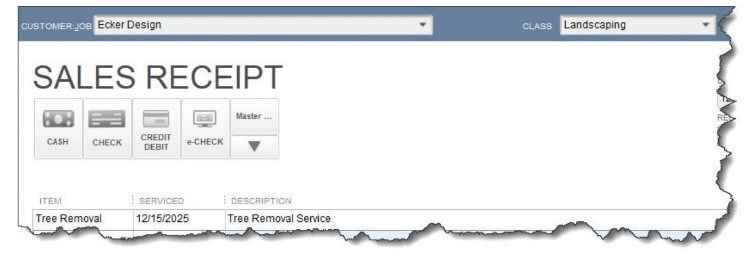

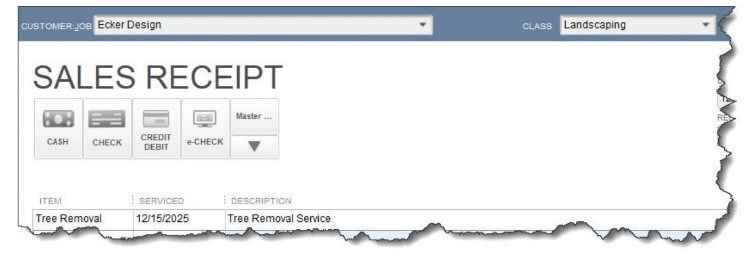

QuickBooks offers multiple types of sales forms that are appropriate for different situations. Here’s a look at when they’re used and how to create them. QuickBooks is very good at providing tools for creating the business forms you need. If you’ve already created...

by Xpressley Bookkeeping | Jan 25, 2023 | Accounting, Quickbooks Online

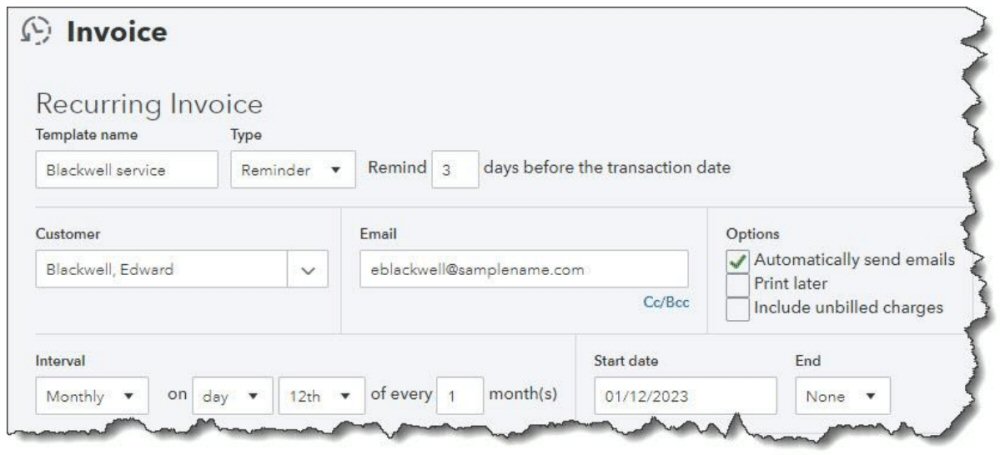

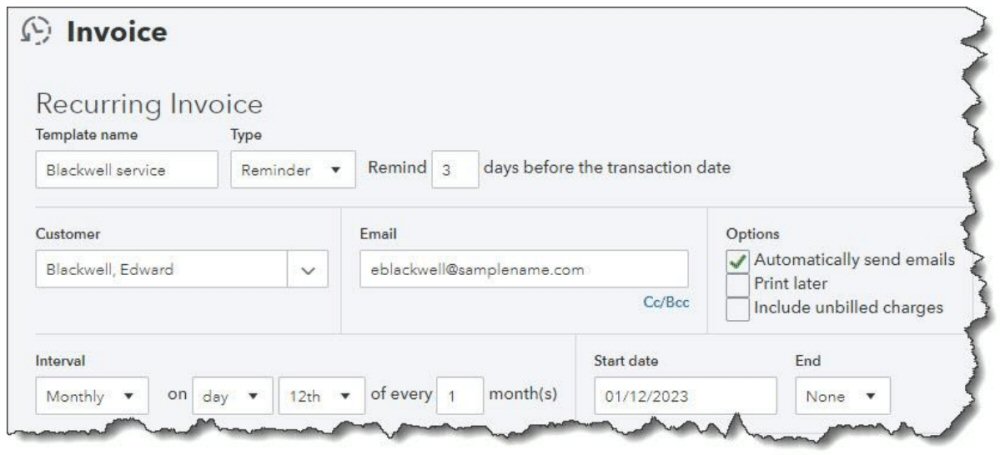

Your time as a business owner is valuable. Don’t waste any of it doing duplicate data entry. Accounting takes time. And the last thing you need when you’re working with your company’s finances is activity that takes unnecessary minutes. If you’ve created a record or...

by Xpressley Bookkeeping | Jan 25, 2023 | QuickBooks Desktop

We’re one month into 2023. Are you ready for what may come the rest of the year? QuickBooks can help. Now that the holidays are over and you’ve settled back into a normal work pace, it’s a good time to assess where you are with your finances and consider where you’d...

by Xpressley Bookkeeping | Jan 3, 2023 | Bookkeeping News, Quickbooks Online, Quickbooks Training

How QuickBooks Can Get Your Finances In Order for 2023 Put 2022 behind you by wrapping up those unfinished accounting tasks in QuickBooks. You meant to clean up your accounting data by the end of 2022, but December is so busy. It was hard to do much beyond managing...

by Xpressley Bookkeeping | Jan 2, 2023 | Bookkeeping News, QuickBooks Desktop, Quickbooks Training

If you haven’t checked out QuickBooks Online free mobile app, you might be surprised at how much it can do. There was a time when leaving the office meant you were done with work for the day. These days, many homes are the office. And easy mobile access has made it...

by Xpressley Bookkeeping | Aug 23, 2022 | Uncategorized

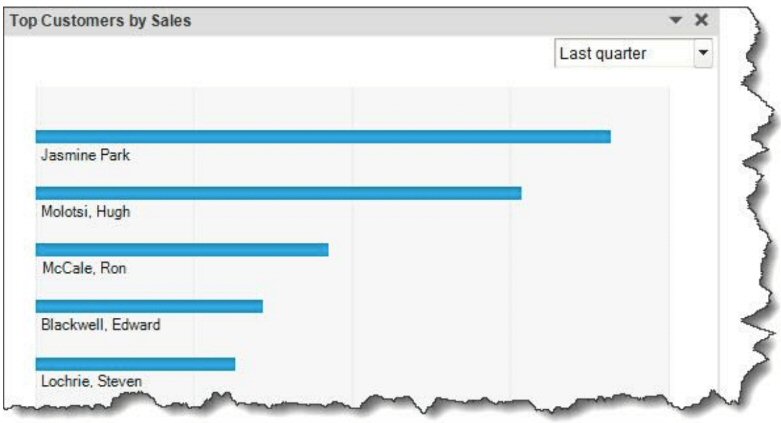

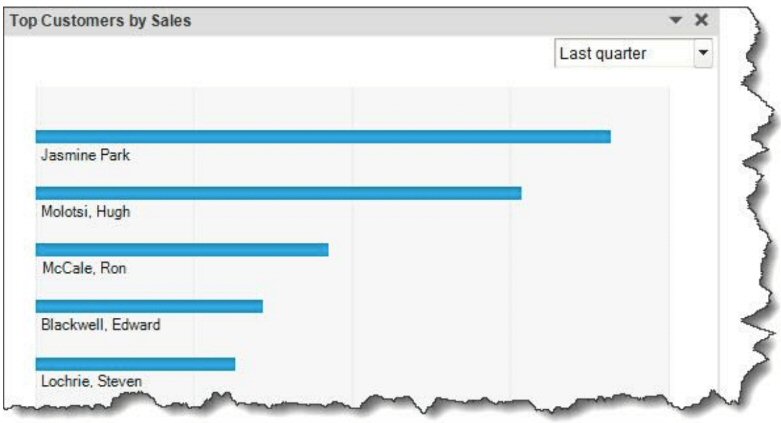

QuickBooks Online provides numerous ways for you to know which customers owe you money–and who is late. There are so many financial details to keep track of when you’re running a small business. You have to make sure your products and services are in good shape and...

by Xpressley Bookkeeping | Aug 23, 2022 | Quickbooks Training

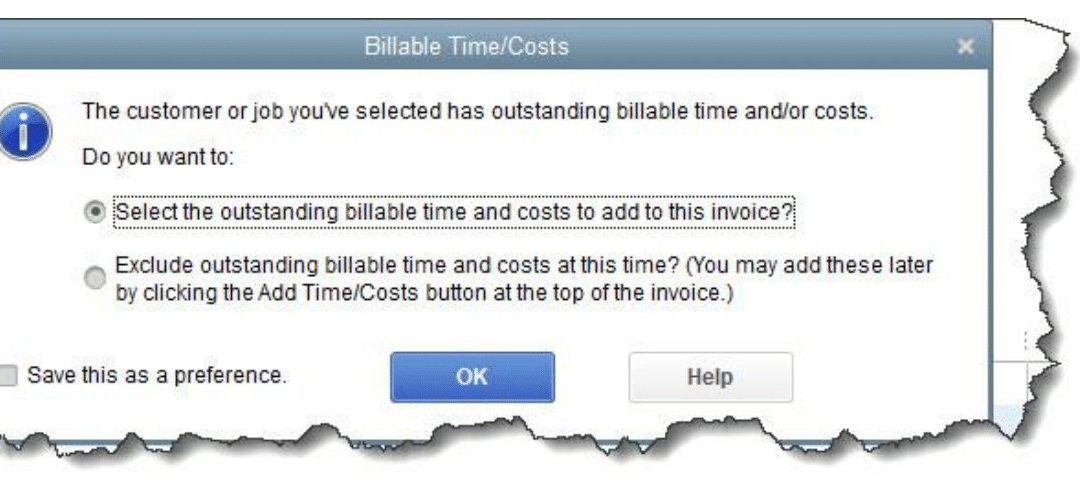

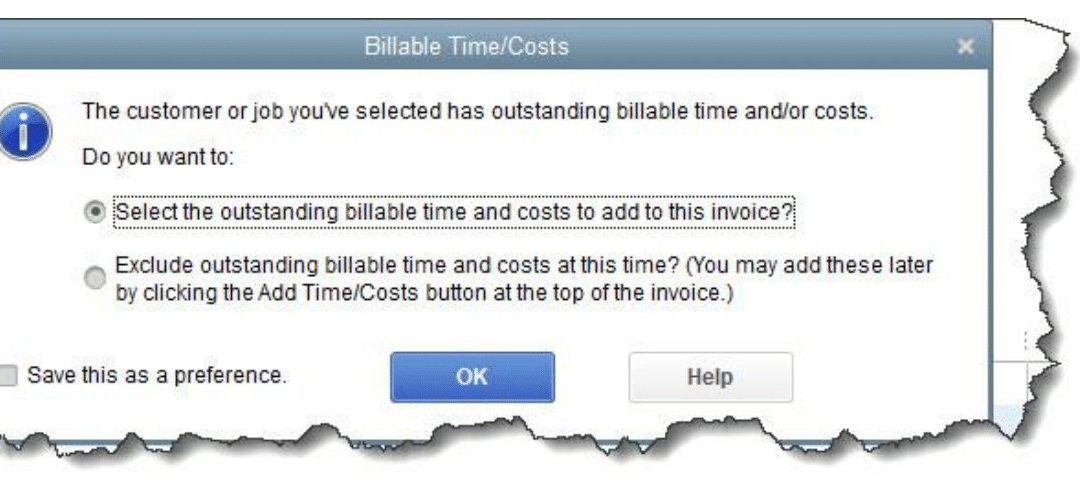

Now that you’ve created some Items and Jobs in QuickBooks, what can you do with them? Last month, we talked about creating Item and Job records in QuickBooks. You can think of a Job as a project your company is doing for a customer, like a marketing campaign or a...