by Xpressley Bookkeeping | Nov 16, 2023 | Accounting, Bookkeeping News, Uncategorized

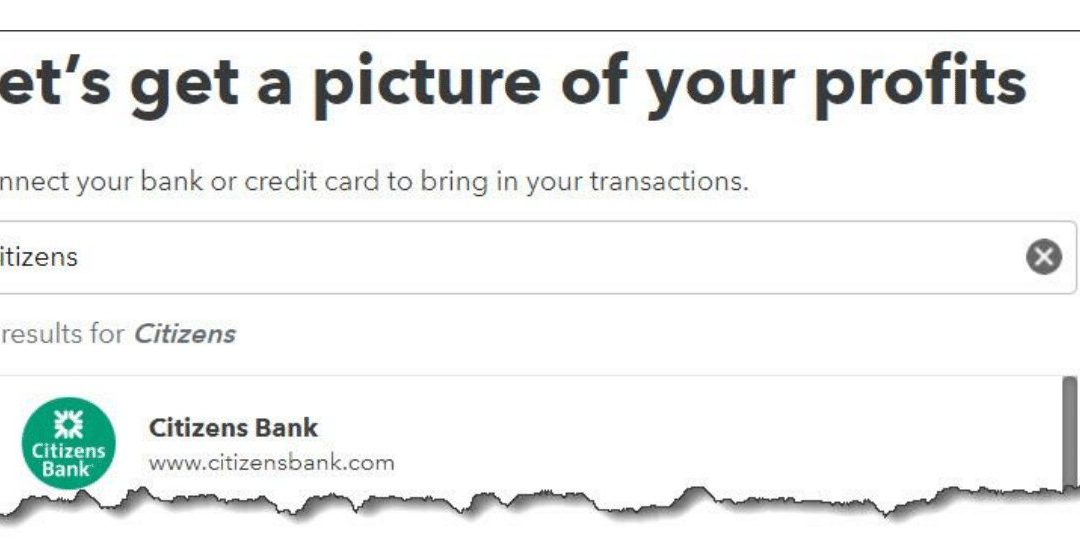

QuickBooks Online makes this an easy trip but be sure you know how the site handles them once you’ve moved them. Manual transaction entry doesn’t make sense anymore–not when QuickBooks Online makes the process of importing them from your bank so easy. If you enter...

by Xpressley Bookkeeping | Nov 16, 2023 | Accounting, Bookkeeping News, Uncategorized

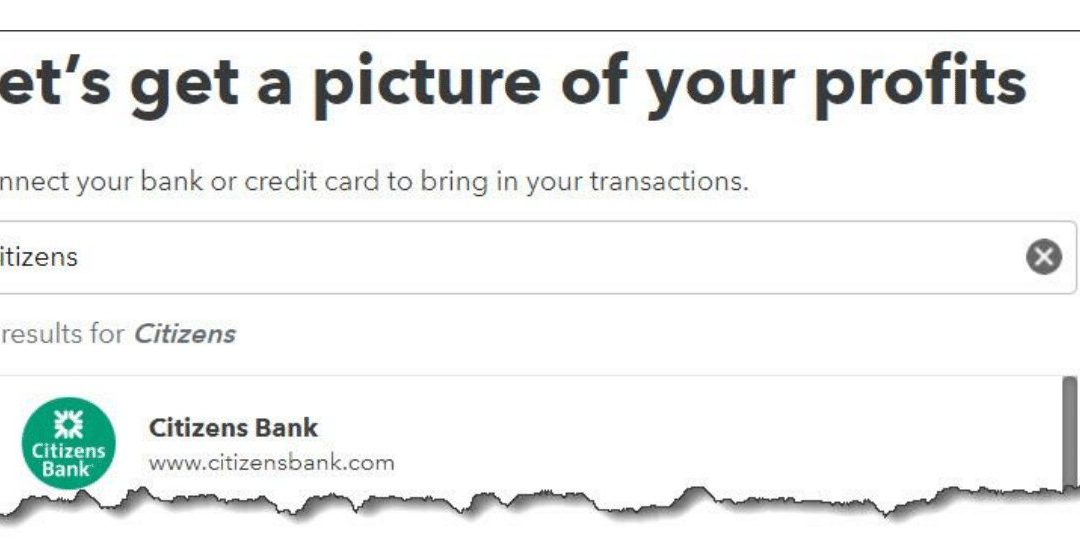

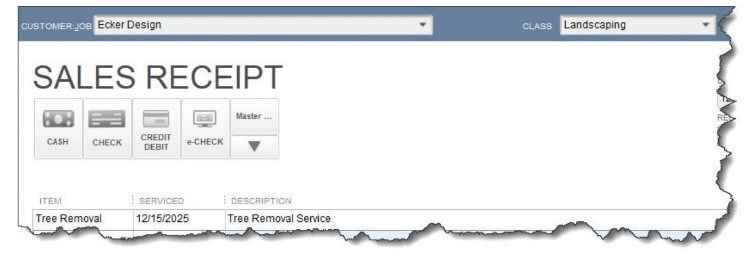

QuickBooks offers multiple types of sales forms that are appropriate for different situations. Here’s a look at when they’re used and how to create them. QuickBooks is very good at providing tools for creating the business forms you need. If you’ve already created...

by Xpressley Bookkeeping | Jan 3, 2023 | Bookkeeping News, Quickbooks Online, Quickbooks Training

How QuickBooks Can Get Your Finances In Order for 2023 Put 2022 behind you by wrapping up those unfinished accounting tasks in QuickBooks. You meant to clean up your accounting data by the end of 2022, but December is so busy. It was hard to do much beyond managing...

by Xpressley Bookkeeping | Jan 2, 2023 | Bookkeeping News, QuickBooks Desktop, Quickbooks Training

If you haven’t checked out QuickBooks Online free mobile app, you might be surprised at how much it can do. There was a time when leaving the office meant you were done with work for the day. These days, many homes are the office. And easy mobile access has made it...

by Xpressley Bookkeeping | Mar 13, 2017 | Bookkeeping News, Quickbooks Training

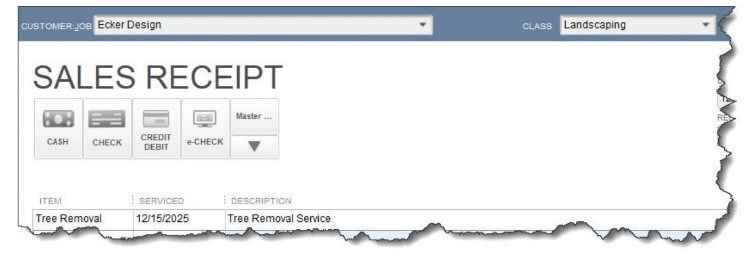

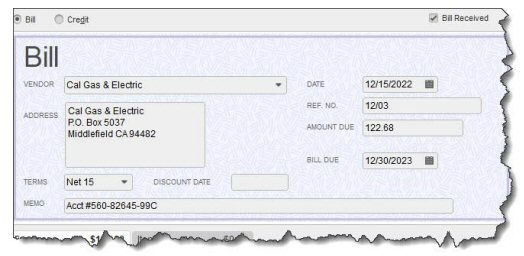

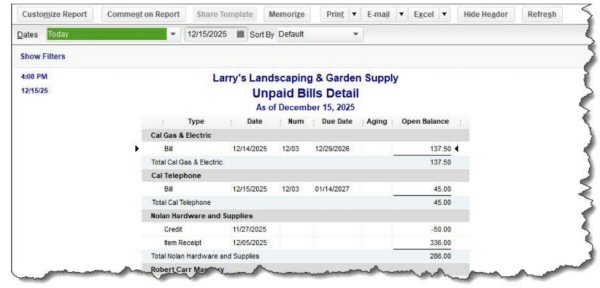

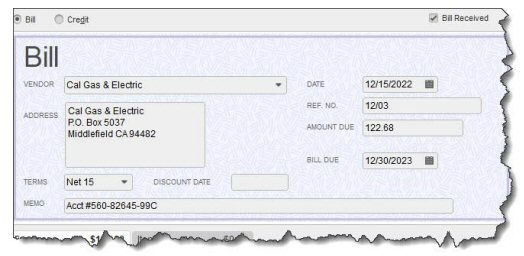

Did you resolve to pay bills on time in 2021? Here’s how QuickBooks can help. Managing your paper bills manually is a dangerous practice. It’s too easy to lose them, for one thing, and it’s impossible to keep all of those vendors and amounts in your head. Even if you...

by Xpressley Bookkeeping | Mar 13, 2017 | Bookkeeping News, Quickbooks Training

Sometimes, you have to spend money on your customers. Make sure you’re billing them for it.Usually, money flows from your customers to your business. But there may be times when you have topurchase items for a job whose costs will eventually be reimbursed. Or you, or...